An impending foreclosure can leave you feeling stressed and unsure of what’s to come. At times like this, it’s normal to feel scared. However, rather than let the fear take over, educate yourself to understand the foreclosure process and how much time you have. The length of foreclosure varies from place to place. If you live in the Sunshine state, you may be asking, “how long does foreclosure take in Florida?”. This is an important question which we will answer today.

A Quick Look at Foreclosure in Florida

Florida is considered a “judicial foreclosure state.” This means that the court system handles all foreclosure proceedings. Since some steps of the process can vary between Florida’s counties, it may be a good idea to hire an attorney.

In general, foreclosure timelines are longer in Florida than any other state in the union. If you read the laws, you will find that the process can take as few as four months. However, it generally takes longer than this.

How Long Does A Foreclosure Take in Florida?

Let’s take a look at the breakdown of the foreclosure process in Florida:

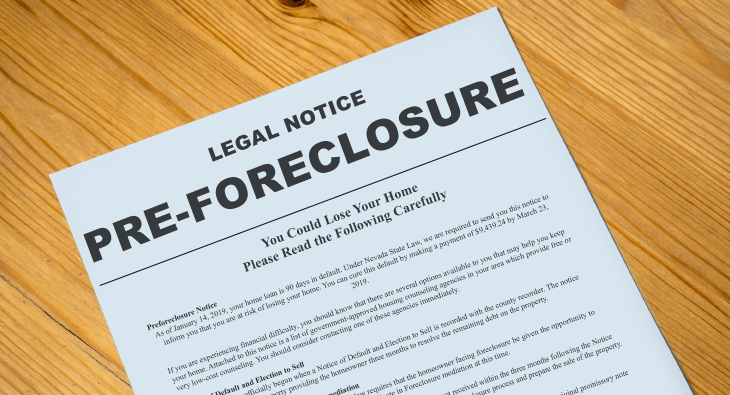

Pre-foreclosure

Pre-foreclosure is the period of time between your first missed mortgage payment and the date the lender filed the foreclosure lawsuit with the court. The first thing you will receive is a letter from the lender demanding payment within 30 days. After this grace period is up, the lender will file the necessary paperwork with the court between 30 and 90 days later.

The Foreclosure Process

Once the court has received the lawsuit, they will attempt to deliver it to the homeowner. Once it’s been received, the homeowner has 20 days to respond with an answer. In this response, the homeowner will either deny or admit to the allegations. How you answer here will decide which direction the court case will go. If you choose to detest the proceedings, it can buy you some more time. By the time you’ve completed each step of this process, it may take as few as four months or as many as 14 months.

What Happens After the Foreclosure is Finalized?

If the hearing sides with the lender, the home will be issued a sale date between 35 and 120 days after the final judgment date. The home will be sold at auction with any individual eligible to bid; the highest bidder is the new owner.

If there are no objections to the sale, the Clerk of Court will issue a title within 10 days of the sale. After the title has been issued, the new owner can file a Writ of Possession to begin the eviction process (when there are tenants in the home). This process will take between 30 and 60 days to complete.

How to Prevent Foreclosure

As you can see, the foreclosure process in Florida can be long. So, rather than sit around and keep asking, “how long does a foreclosure take in Florida,” contact your lender and see if there’s a payment plan to help get you caught up. You can also check into finding a company that buys homes for cash or contact a local attorney to assist you.

Read Next: How to Stop Foreclosure at Last Minute